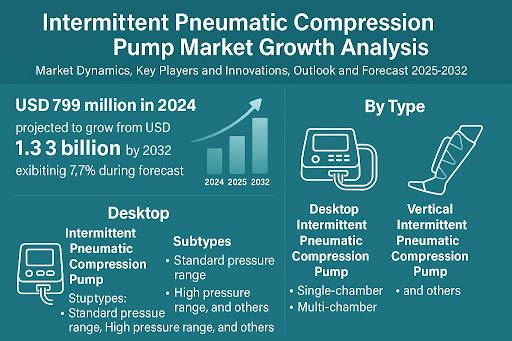

The global intermittent pneumatic compression (IPC) pump market was valued at USD 799 million in 2024 and is projected to grow from USD 850 million in 2025 to USD 1.3 billion by 2032, exhibiting a CAGR of 7.7% during the forecast period.

Intermittent pneumatic compression pumps are medical devices designed to improve circulation and prevent deep vein thrombosis (DVT) by mimicking natural muscle contractions through sequential inflation of limb cuffs. These devices play a critical role in post-surgical recovery, lymphedema management, and chronic venous insufficiency treatment across hospital, clinic, and home care settings.

Get Full Report Here: https://www.intelmarketresearch.com/reports/963/intermittent-pneumatic-compression-pump-2025-2032-784

What are Intermittent Pneumatic Compression Pumps?

Intermittent pneumatic compression pumps are medical devices designed to prevent deep vein thrombosis (DVT) and improve blood circulation by mechanically mimicking natural muscle contractions. These systems utilize inflatable sleeves that sequentially compress limbs with precisely controlled pressure, preventing blood stagnation that leads to clot formation. While initially developed for post-surgical patients, IPC pumps now serve broader applications including lymphedema management, chronic venous insufficiency, and post-traumatic rehabilitation.

Modern IPC systems come in various configurations – from hospital-grade multi-port pumps to compact wearable devices featuring Bluetooth connectivity and cloud-based compliance monitoring. Leading manufacturers like DJO Global and Cardinal Health have recently introduced smart pumps with AI-driven pressure adjustment capabilities, significantly enhancing patient comfort and treatment efficacy.

MARKET DRIVERS

Rising Prevalence of Venous Thromboembolism to Accelerate Market Demand

The global burden of venous thromboembolism (VTE) which includes deep vein thrombosis (DVT) and pulmonary embolism (PE) is a significant driver for the growth of the Intermittent Pneumatic Compression (IPC) pump market. According to the Centers for Disease Control and Prevention (CDC), VTE affects up to 900,000 people in the United States each year, with 60,000–100,000 deaths annually attributed to complications. A substantial portion of these cases are hospital-acquired, highlighting the critical need for effective preventive solutions like IPC devices.

Moreover, the International Society on Thrombosis and Haemostasis (ISTH) estimates that in Europe, VTE contributes to over 500,000 deaths annually, exceeding the combined death toll from breast cancer, prostate cancer, AIDS, and traffic accidents.Real-world application of IPC pumps is evident in post-surgical care for orthopedic and bariatric patients, where mobility is temporarily restricted. For instance, hospitals across the UK have widely adopted IPC devices as part of standard prophylactic protocols following total hip or knee replacement surgeries, significantly reducing incidences of post-operative DVT.

Technological Advancements in Home Healthcare Devices to Expand Accessibility

Recent innovations in IPC pump design are transforming the market landscape. Manufacturers have successfully developed lightweight, portable units weighing under 2kg that maintain clinical efficacy while offering unprecedented patient convenience. These advancements align perfectly with the broader healthcare shift toward home-based treatments, which accelerated during the pandemic. Modern IPC pumps now incorporate Bluetooth connectivity for remote monitoring and mobile app integration, allowing clinicians to track compliance and adjust therapy parameters digitally. Such features have been particularly impactful in managing chronic lymphedema cases, where long-term treatment adherence is critical. As healthcare systems worldwide emphasize cost containment through outpatient care, these technological improvements create significant growth opportunities.

MARKET OPPORTUNITIES

Emerging Markets to Offer Significant Growth Potential

Developing economies present substantial untapped opportunities as healthcare infrastructure improves and awareness of VTE prevention grows. Countries like India and Brazil, where surgical volumes are increasing at 7-9% annually, represent particularly promising markets. Local manufacturers are already introducing cost-competitive IPC systems priced 40-50% below imported alternatives, addressing affordability barriers. Smart partnerships between global brands and regional distributors could accelerate market penetration, especially if combined with physician education initiatives about thrombosis prevention standards.

Integration with Digital Health Platforms to Create Value-Added Services

The convergence of IPC technology with digital health ecosystems opens new revenue streams and improves patient management. Cloud-connected devices can transmit real-time compliance data to electronic health records, enabling risk-adjusted reimbursement models. Some manufacturers are experimenting with AI-driven pressure modulation that automatically adjusts compression based on biometric feedback. These innovations transform IPC pumps from simple mechanical devices into intelligent nodes within connected care networks, justifying premium pricing while delivering measurable improvements in patient outcomes.

Intermittent Pneumatic Compression Pump Market – Segment Analysis

By Type

Desktop Intermittent Pneumatic Compression Pump Segment Leads Due to Enhanced Mobility and Hospital Adoption

The market is segmented based on type into:

- Desktop Intermittent Pneumatic Compression Pump

- Subtypes: Standard pressure range, High pressure range, and others

- Vertical Intermittent Pneumatic Compression Pump

- Subtypes: Single-chamber, Multi-chamber, and others

By Application

Deep Vein Thrombosis (DVT) Prevention Segment Dominates Due to Rising Surgical Procedures

The market is segmented based on application into:

- Deep Vein Thrombosis (DVT) Prevention

- Lymphedema Management

- Chronic Venous Insufficiency Treatment

- Postoperative Recovery

- Others

By Patient Demographics

The market is segmented based on Patient Demographics into:

- Geriatric

- Adult

- Pediatric

By End User

Hospitals and Clinics Segment Leads Due to Increased Patient Admissions for Circulatory Disorders

The market is segmented based on end user into:

- Hospitals and clinics

- Rehabilitation Centers

- Household

Recent Developments and Market Trends in the Intermittent Pneumatic Compression Pump Market

- Rising Prevalence of Chronic Venous Disorders and Lymphedema

Increased global cases of chronic venous insufficiency, lymphedema, and deep vein thrombosis (DVT) are fueling demand for IPC pumps in both clinical and homecare settings. - Technological Advancements in Pump Design

Leading manufacturers are focusing on compact, lightweight, and wearable IPC devices that offer enhanced mobility, battery operation, and intelligent pressure control, improving patient compliance and comfort. - Integration with Digital Health Platforms

Recent product innovations include Bluetooth-enabled IPC pumps that sync with mobile apps, allowing for real-time monitoring, usage tracking, and remote therapy adjustments by healthcare professionals. - Home Healthcare Sector Expansion

The shift toward home-based care—particularly post-COVID—has driven the adoption of user-friendly IPC devices that enable patients to manage DVT prevention and lymphedema therapy from home. - Favorable Reimbursement Policies in Developed Markets

Countries like the U.S., Germany, and Japan are updating health insurance and reimbursement frameworks for compression therapy devices, making IPC pumps more accessible to patients. - Strategic Partnerships and Product Launches

Companies such as Bio Compression Systems, DJO Global, and Arjo are investing in product development, geographic expansion, and distribution partnerships to strengthen their global footprint. - Eco-Friendly and Sustainable Materials in Manufacturing

There’s a growing trend toward the use of recyclable and low-impact materials in IPC pump components, aligning with the global shift toward green medical devices.

Report Scope & Offerings

This comprehensive analysis delivers actionable insights into:

- Precise market sizing across segments and regions

- Technology adoption curves for next-generation devices

- Competitive benchmarks covering 14 leading manufacturers

- Regulatory and reimbursement landscape analysis

Get Full Report Here: https://www.intelmarketresearch.com/reports/963/intermittent-pneumatic-compression-pump-2025-2032-784

Explore Pathology Devices Market

About Intel Market Research

Intel Market Research delivers actionable insights in technology and infrastructure markets. Our data-driven analysis leverages:

- Real-time infrastructure monitoring

- Techno-economic feasibility studies

Competitive intelligence across 100+ countries

Trusted by Fortune 500 firms, we empower strategic decisions with precision.

International: +1(332) 2424 294 | Asia: +91 9169164321

Website: https://www.intelmarketresearch.com

Follow us on LinkedIn: https://www.linkedin.com/company/intel-market-research

The macro analyst desk brings highly sought after financial news based on market analysis, insider news and company filings.